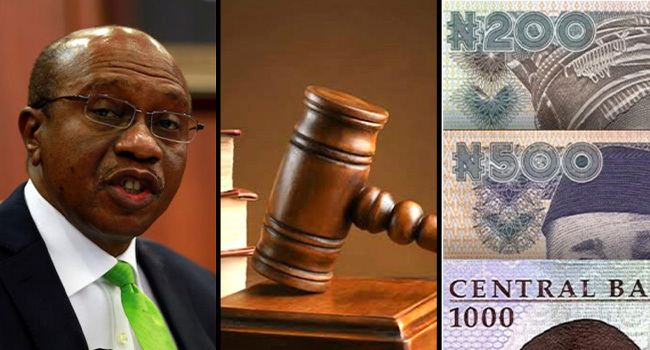

ABUJA, Nigeria (VOICE OF NAIJA) – Nigerians have complied fully with the new directive by the Central Bank of Nigeria (CBN) that old N200, N500 and N1000 notes remain legal tenders.

The CBN directive is in obedience to the Supreme Court ruling which flawed the naira redesign policy and asked that the old notes remain a legal tender till December, 2023.

The Supreme Court had on Friday, 3 March 2023, in a suit filed by Kaduna, Kogi, Zamfara and seven other States against the naira redesigned policy of the CBN, nullified the policy while directing that the old naira notes remain legal tender till 31 December 2023, setting aside the deadline of the apex bank in the country.

On Monday, 13 March, 2023 Godwin Emefiele, via a statement signed by Isa Abdulmumin, CBN’s Acting Director of Corporate Communications, informed that the CBN will now comply with the directive of the Supreme Court ruling.

“In compliance with the established tradition of obedience to court orders and sustenance of the Rule of Law Principle that characterized the government of President Muhammadu Buhari, and by extension, the operations of the Central Bank of Nigeria (CBN), as a regulator, Deposit Money Banks operating in Nigeria have been directed to comply with the Supreme Court ruling of March 3, 2023.

“Accordingly, the CBN met with the Bankers’ Committee and has directed that the old N200, N500 and N1000 banknotes remain legal tender alongside the redesigned banknotes till December 31, 2023.

“Consequently, all concerned are directed to conform accordingly,” the statement by the CBN read.

Findings by voiceofnaija.ng have now revealed that Nigerians across the country have started accepting the old notes as a means of transaction.

Some of the petty traders who spoke with our correspondent noted that they were well aware of the CBN directive and have since started accepting the old notes.

“Efiele (sic) has already announced that we should start collecting the old notes, so I’ve started taking it,” a middle-aged woman selling baby clothes in Iyana Ipaja area of Lagos stated in Yoruba.

A commercial bus driver who travels from Lagos to Kwara State noted that commercial buses have started accepting the old notes as a means of payment, but expressed worry over compliance in rural areas.

He said: “I’ll have to call my family in Kwara State to inform them of this new development because they may be proving stubborn despite the new directive.”

As observed on the streets too, many food sellers and hawkers have started accepting the old notes for transactions as the old notes are returned into circulation.